Salvation Army Free Income Tax Clinics Benefit Low-Income Individuals and Families

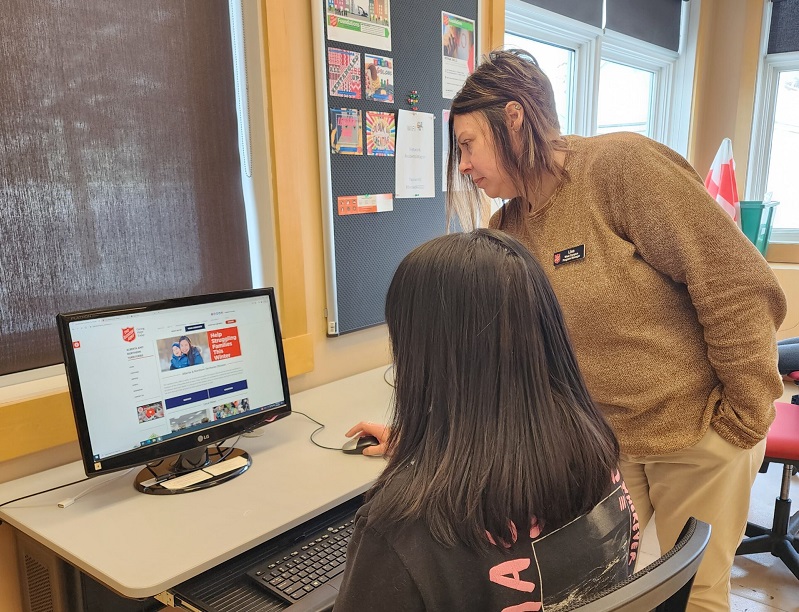

It’s income tax time and, for people with low-incomes, the cost to complete the forms is one more thing to worry about. With one in 10 Canadians living in poverty, The Salvation Army offers a number of free income-tax clinics which, in partnership with the Canada Revenue Agency, ease financial burdens and, sometimes, put more money into the pockets of people who need it most.

Matt Saunders, a chartered accountant, has volunteered at The Salvation Army’s tax clinic in Oshawa, Ont., for many years. “The need for this free service is critical,” says Matt. “If people can’t afford to have their tax forms completed, they don’t file. And the impact of not filing means they don’t qualify for the GST credit, property tax credit or child tax benefits. That can add up to more than $100 dollars a month in someone’s pocket. That’s substantial for people who are hurting financially.”

Last year, The Salvation Army’s Community and Family Services CVITP (Community Volunteer Income Tax Program) in Edmonton helped to put more than $5 million into the pockets of low-income people.

“The numbers of people using our service continues to grow,” says Cheryl Brown, Volunteer Coordinator. “For students filing for the first time, or newcomers with language barriers, or seniors who aren’t computer literate, preparing taxes can be stressful, not to mention expensive. Without this service some people just don’t file and benefits they qualify for slip through the cracks.”

During the 2015 tax season, 35 volunteers filed 3,146 returns. Five years ago, the Edmonton office responded to the need for an after-tax program, giving people a second chance to correct their tax affairs. From March to November, once a week, volunteers prepare paper returns for one to 10 years of back taxes.

During the 2015 tax season, 35 volunteers filed 3,146 returns. Five years ago, the Edmonton office responded to the need for an after-tax program, giving people a second chance to correct their tax affairs. From March to November, once a week, volunteers prepare paper returns for one to 10 years of back taxes.

“It’s fulfilling to see tears of excitement when struggling people learn they are eligible for GST and child tax benefits, or can claim bus passes, prescriptions and tuition,” says Brown. ”We are happy to give them that extra little bit of hope.”